Australia is a global leader in mineral production, with mining contributing around 10% to the national GDP. Backed by a resource-rich landscape and supportive government policies, the country remains a top destination for mineral exploration investments. .

The sector’s growth has a ripple effect, boosting industries like mining equipment, technology, and services. In the latest quarter, mineral exploration expenditure rose by 1.3%, reflecting ongoing investor interest and activity.

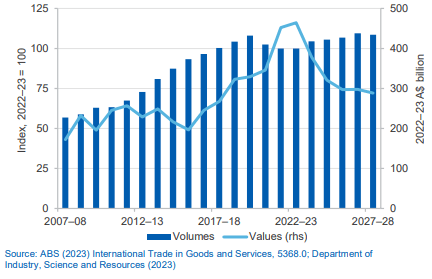

According to the ATO Corporate Tax Transparency Report, the mining industry paid a massive $43.1 billion in company tax for 2022–23—the highest of any sector. Our Aussie Mining Report uncovers these trends in depth, mapping out commodity-specific opportunities and investment potential stock-by-stock.Note – *Source: ABS(2023) International Trade in Good and Services, Department of Industry, Science and Resources (2023)*

Why Our Reports Are Best In The Market ?

What You Are Going to Get In Our Report ?

Top 5 ASX Mining Stocks

Expert Analysed And Curated Report

In Depth Technical Analysis of these best 5 Stocks which will help you get started

Easy to Understand , No Complex Information

Get Our Best Seller Report For Free

No Credit Card Required. No Hidden Charges

Success Story

Reports

Satisfed Customers

Reviews

ASX Companies Analysed

Testimonials

FAQs

1.What is the top mining company in Australia?

2. Are mining shares a good investment?

3.Where is the largest lithium mine in Australia?

4.What are ASX mining stocks?

5.How can I research ASX mining stocks before investing?

At Veye, we understand that making investment decisions can be a daunting task. That’s why we offer comprehensive market research on ASX stocks to help investors navigate the complexities of the market and make informed decisions about buying, selling or holding stocks.Our team of expert analysts conducts rigorous research and analysis to provide unbiased recommendations on a range of stocks across various industries. Our reports are designed to be accessible to all investors, regardless of their level of experience or financial expertise.

Our research is conducted with a focus on accuracy and objectivity, ensuring that our clients receive the most reliable and trustworthy information possible about individual stocks.